September 2025 Market Report

September 2025 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

September already? The CNE’s packed up, the kids are back to school, and pumpkin spice is quietly plotting its comeback.

Toronto is shifting gears, from summer patios to fall routines, and the real estate market is doing the same.

The Fall Market is traditionally one of the busiest seasons in Toronto real estate. With buyers focused, sellers motivated, and a fresh wave of listings hitting the market after Labour Day, it’s a prime time to make a move.

Whether you’re settling back into city life, keeping an eye on your neighbourhood’s activity, or thinking about a fall sale, we’ve got you covered.

Here’s your September 2025 Market Update. Your go-to for the latest stats, insights, and trends to help you stay ahead.

What We Are Seeing From the Field

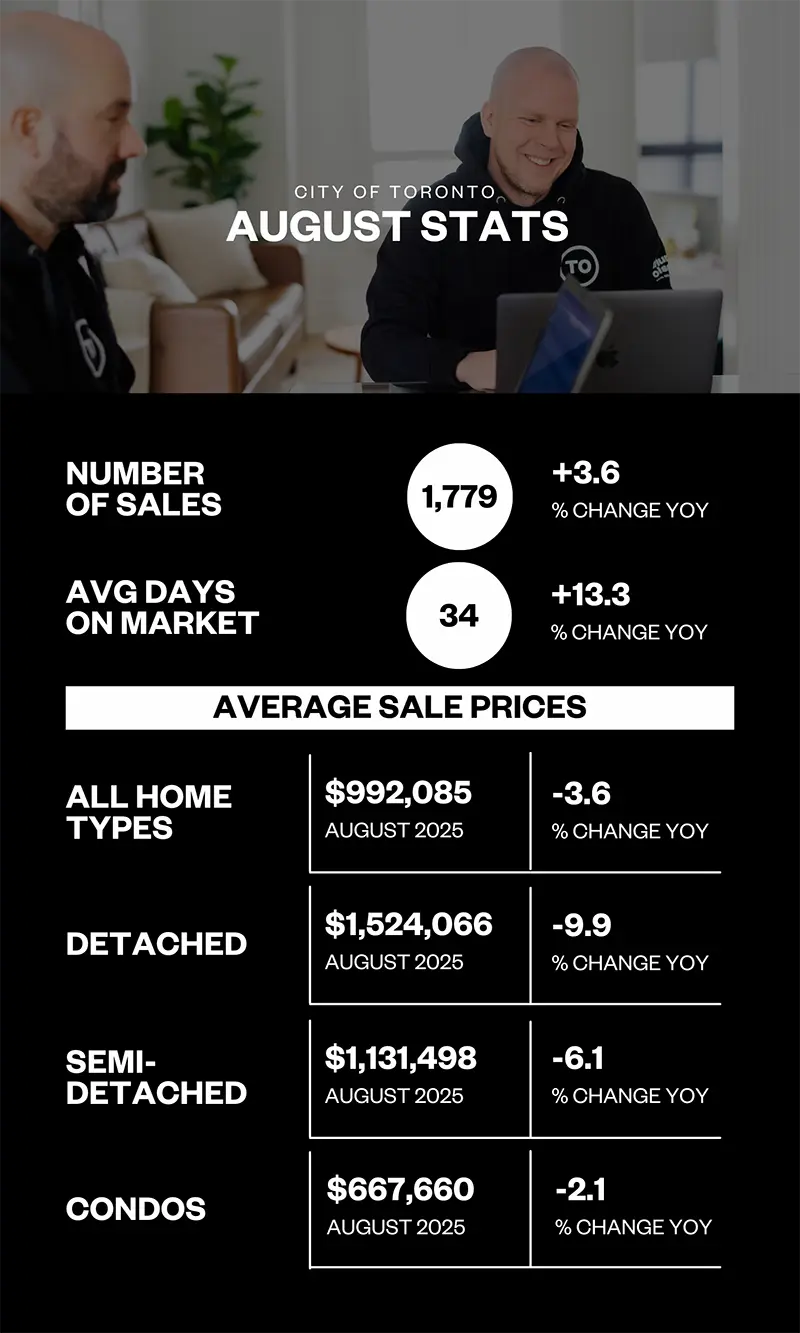

Out in the field this past month, the story has been about choice. August sales were up compared to last year, but new listings climbed even higher, giving buyers the upper hand in negotiations. With average prices sitting 3.6% lower year-over-year, many buyers are taking their time, shopping around, and some securing homes below asking. With that said, the right houses are still attracting eager buyers, and in many cases, multiple offers!

For sellers, this means strategy is key, homes that are well-priced and well-presented are the ones that stand out and sell.

While activity dipped slightly from July, the market is still well-supplied heading into fall. With interest rates holding steady, and whispers of future cuts (possibly even a .25% cut this month), there’s a sense that more buyers could step back in as affordability improves.

In short, it’s a balanced market with opportunities on both sides, and the next few months could be an important window for making a move. The key is knowing how to navigate the market (we can help with that ).

Check out the August year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

What Is Bridge Financing (And Why Might You Need It)?

Buying your next home before your current one closes is a common occurrence in real estate, and it’s crucial that you have your ducks in a row, before you pull the trigger.

That’s where bridge financing comes in. It’s a short-term loan that lets you tap into the equity from your existing home so you can put a down payment on your next one, without waiting for the sale to officially close.

Why it matters:

– You can secure your dream home without stressing over matching closing dates (super important if competing for your new home).

– It gives you breathing room to accept the best offer on your current place, even if the dates don’t line up.

– Extra flexibility: move in gradually, do a few renos, or skip the hassle of temporary housing and storage.

How it works:

Once your current home is sold (firm deal in place), your lender can set up a bridge loan that gets paid back when your sale closes. Most lenders offer them, but the key is that your mortgage is usually with the same lender.

A pro tip:

If possible, negotiate a longer closing date on your purchase. Lenders often need at least 15 business days between your sale and purchase closing dates to make the bridge financing process smooth and stress-free.

What does it cost?

Bridge loans are short-term (usually 30–90 days), with interest rates a bit higher than your mortgage (typically 2–4% above prime) and sometimes a flat admin fee ($200–$500). The good news? Since they’re short-lived, costs usually stay manageable.

Part of our job is making sure you’re set up for success. It’s the little details that can easily get missed without the right guidance, and that’s where we come in. With our experience and network of trusted professionals, we’ll help make your next move as smooth as possible. Have questions? Just reach out, we’re here to help!

COMING SOON!

The Fall market is starting off with a bang and we’re very excited to share that we’ve got three awesome new listings hitting the market this month!

A super-cool loft in the heart of King West with a huge private terrace and CN tower views, a wide and character-filled Beaches semi with tons of potential, and a Leslieville detached beauty, steps to Greenwood Park that checks all the boxes.

If one of these sounds like it could be your next move (or you know someone who’s looking), let’s chat! These gems won’t last long!

We’re Here To Help!

As always, we would be happy to help you and any of your friends, family, colleagues, or neighbours with real estate services or advice. If you can think of anyone who could use our help, feel free to make an introduction! We promise we’ll make you look good.

Cheers!

Chris and Ford

August 2025 Market Report

August 2025 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

Hard to believe it’s already August! The CNE is around the corner, sunset patios are hitting golden hour perfection, and those last few summer Fridays are calling our name!

Real estate-wise, things may feel a little quieter this month – but make no mistake, the Toronto market never truly sleeps. With interest rates holding steady and more inventory to choose from, smart buyers are poking around, and savvy sellers are prepping for an optimistic fall market.

Whether you’re planning a September sale, or just curious how things are shaping up in your neighbourhood, we’re always here to help.

Here’s your August 2025 Market Update, packed with fresh stats, expert insights, and everything you need to stay in the know.

What We Are Seeing From the Field

The Toronto real estate market just posted its strongest July sales performance since 2021, with home sales up 11% year-over-year. Buyer activity outpaced supply, leading to a tightening in market conditions compared to July of last year.

What’s driving the action?

Improved affordability is starting to bring more buyers off the sidelines. With home prices and borrowing costs down from last year, more households are finally seeing homeownership as an achievable goal again. It’s still a work in progress – especially on the interest rate side, but the momentum feels real.

The Outlook?

If we continue to see rate relief and stable pricing, buyer confidence could continue to build. At the moment, we are seeing some fantastic opportunities for buyers in the current market – homes that don’t check every box equals a chance to potentially acquire a home for a great deal.

For sellers, it’s more important than ever to ensure your listing shows at a 10/10 (we can help with this ?) – we are still seeing multiple offers for some well promoted and priced homes.

As always, we’re keeping a close eye on the numbers so you don’t have to. Whether you’re buying, selling, or just staying in the loop, we’re here to help you navigate it all.

Check out the July year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

List Later, Shoot Now: Why Summer Photos Are A Fall & Winter Listing Game-Changer

Planning to sell this fall or winter? Here’s a pro tip: take your listing photos now while the sun is shining and the landscaping is lush.

Homes almost always show better when the grass is green, flowers are blooming, and the light is golden. If you wait until November, your beautiful home could be hidden under bare trees, cloudy skies, or a foot of snow.

That’s why we’re offering a limited-time summer photo promo* for anyone thinking ahead.

We’ll arrange to capture gorgeous professional exterior shots now – so when you’re ready to list later, your property stands above the crowd!

Click below to book your complimentary summer shoot and beat the seasonal blues before they even arrive.

Your future listing (and your future self) will thank you!

*Limited time offer. Terms and conditions apply

Thank You For Joining Us At Our “Summer Scoops With The TO Group” Appreciation Event!

A huge THANK YOU to everyone who stopped by Greenwood Park last Saturday for our “Summer Scoops with the TO Group” appreciation event!

It was such a blast seeing so many familiar faces (and meeting some new ones) over cool treats, sunshine, and a few competitive rounds of cornhole!

We’re grateful to be part of such a warm, fun-loving community – and we can’t wait to do it again next year.

We’re Here To Help!

As always, we would be happy to help you and any of your friends, family, colleagues, or neighbours with real estate services or advice. If you can think of anyone who could use our help, feel free to make an introduction! We promise we’ll make you look good.

Cheers!

Chris and Ford

April 2025 Market Report

April 2025 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

If you know the TO Group, you know we live for this time of year—not just because Blue Jays baseball is back, but because the Spring Market is heating up!

There’s something about that first crack of the bat that signals the start of a fresh season… and in real estate, it’s no different.

Spring is when the market shakes off the winter frost and comes alive—more listings, more buyers, and more opportunities for families to hit a real estate home run (if one of us is a Dad, does that give us permission to make jokes like that?)

Whether you’re scouting the field for your next place, considering a sale, or just like staying in the know, we’ve rounded up all the key stats and insights to help you make smart moves this spring.

Let’s dive into your April 2025 Real Estate Update—Play Ball!

What We Are Seeing From the Field

We’ve seen some encouraging shifts in the Toronto real estate market this March despite the constant news reports of tariffs, struggling economies, political instability, etc.

But let’s take a closer look at the numbers

Compared to last year, homeownership is becoming more accessible—great news for buyers who’ve been sitting on the sidelines. But for sellers? The sky is not falling. In fact, average prices in the City of Toronto are actually up 2.2% year-over-year—a sign that demand for urban living is still going strong.

Toronto March 2025 Highlights:

-

Home sales: down 17.3%

-

New listings: up 30.6%

-

Average price: up 2.2%

More listings means more choice for buyers, which naturally cools competition a little—but it also brings serious buyers into the market who now feel they can shop around and make confident decisions. If your home is priced well and shows beautifully, you’re still in a solid position to attract attention.

GTA-Wide Trends (for comparison):

-

Home sales: down 23.1%

-

New listings: up 28.6%

-

Average price: down 2.5%

Compared to the GTA as a whole, Toronto is holding its value better and proving that location still matters. We’re also keeping a close eye on interest rate movements—expected cuts this spring could spark renewed activity and bump demand.

Bottom line? Whether you’re buying, selling, or just curious, this market has opportunities—you just need the right game plan. And hey, that’s where we come in

Check out the March year-over-year stats below for more information on the current market. If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

In the News

We always get a kick out of some of the headlines we see about Toronto real estate.

We get it—journalists need to grab attention, and a dramatic headline is a great way to get people clicking and reading.

The problem? Sometimes those catchy titles can lead to a misunderstanding of the facts, which can stir confusion and even impact the market itself.

So, we thought we’d share a couple of recent headlines and offer some context. We’d love to hear your take, too! Feel free to reply to this email or give us a call. It’s always refreshing to hear perspectives from outside the Toronto real estate bubble we live in every day.

Headline: “Buyers offering way under asking price for homes in most parts of Toronto Area”

You might assume that prices have dropped significantly—but is that really the case? The truth is, listing strategies are always changing.

When a home sells “over asking,” it’s often just selling for market value. In many neighbourhoods, sellers will price a home below its true value to attract more buyers and spark competition. The goal? Drive the price up and sell “over asking.”

But that doesn’t always work.

Sometimes the market doesn’t respond, and the seller re-lists at a higher price with room to negotiate downward—closer to true market value. It all depends on the neighbourhood, timing, and what strategy is working that week. If we look at the average value of a home in the City of Toronto comparing March to February of 2025, the price has actually increased by 2.2%, which would prove that prices are not tumbling.

The market is always shifting and that’s why it’s extremely important to hire a professional who works in the market 7 days a week (that’s us!).

Headline: “Canadian Mortgage Arrears Climb To The Highest Rate Since 2021”

At first glance, that headline may have you thinking Canada is in serious trouble and homeowners are dropping their keys at the bank. But let’s take a breath and look at the facts.

First, a quick reminder: a mortgage is technically in arrears if a payment is just one day late. That’s it! And while the term sounds scary, it’s one of the most misunderstood economic indicators out there.

Yes, rising costs have made it harder for many households to stay perfectly on track. And yes, sometimes a late payment happens—not always because someone can’t afford their home, but because there’s simply less wiggle room these days.

Let’s look at the actual data:

The Canadian Bankers Association recently reported that the mortgage arrears rate in Canada rose slightly to 0.22% in January. That’s a 57% increase from the record low in 2022—but still well below 1%.

So, is that really a sign of mass panic? Or just a small shift in a very large system?

If you know us, you know we’re generally glass-half-full kind of guys. Of course, we never want to see anyone default on a mortgage—but let’s not let scary headlines paint an exaggerated picture. This is more of a blip than a crisis, in our humble opinion.

Do you have any other headlines that you’d like for us to analyze and provide perspective? Feel free to send them our way!

We’re Here To Help!

As always, we would be happy to help you and any of your friends, family, colleagues, or neighbours with real estate services or advice. If you can think of anyone who could use our help, feel free to make an introduction! We promise we’ll make you look good.

Cheers!

Chris and Ford

March 2025 Market Report

March 2025 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

Hope you all made it through Snowmageddon in one piece—backs intact and shovels retired (for now)!

Spring is around the corner, and the real estate market is starting to heat up! Whether you’re thinking of buying, selling, or just love staying in the know, March is the perfect time to get ahead of the curve.

From market insights to expert tips, we’ve got everything you need to make smart real estate moves this season. Let’s dive into another Real Estate Update for March 2025!

What We Are Seeing From the Field

February was an interesting month in Toronto real estate.

Comparing year-over-year numbers, we saw an increase in inventory, a dip in the number of sales, and a slight uptick in the average price of a home. Right now, condo apartments and condo townhomes make up roughly 70% of all active listings in Toronto, while freehold homes (detached, semi-detached, row houses) are trading faster than condos.

OPPORTUNITY ALERT!

If you’ve been thinking about downsizing from a freehold home to a low-maintenance condo, this could be the perfect time to make your move. With increased inventory and shifting market dynamics, the opportunity to maximize the sale of your current home and secure a great condo deal is here.

We know there’s a lot of economic uncertainty in the air—tariffs, the stock market, elections, interest rates… the list goes on. But here’s some perspective:

Real estate has traditionally been one of the most stable long-term investments. Housing is a fundamental necessity that the general population puts at the top of their list.

Market uncertainty often presents some of the best investment opportunities. Maybe now is your time to capitalize on the market.

Check out the February year-over-year stats below for more information on the current market. If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

Opportunity Knocks – On Multi-Unit Doors

Toronto’s multi-unit housing market is in a sweet spot, but the clock is ticking. Prices dipped when interest rates jumped, leaving investors struggling to make rental income work. But here’s the thing: rates have started to drop, more rate decreases are expected, and new lending rules have slashed down payment requirements—making NOW a prime opportunity before prices shoot back up.

How Much of a Difference Does This Make?

Let’s break it down with a real-world example on a $1.2M multi-unit home in Toronto:

Key Takeaways:

Drastically Lower Down Payment – Saving for a home has become harder with rising costs, but now you need $145K LESS upfront to get into the market. That’s nearly 5 years’ worth of savings for an average couple making $200K/year (assuming a 15% savings rate).

Waiting Could Cost You Big Time – If home prices conservatively rise just 3% per year, this same $1.2M home could be worth approximately $1.4M in five years. Why wait to pay more later?

“But What About the Monthly Mortgage Payment?”

We get it—$5,500/month isn’t pocket change. But what if a tenant helped cover a big chunk of that?

House Hack Your Way to Homeownership:

Let’s say you buy a 2-unit home (both units with 2 bedrooms), you live in one unit while renting out the other:

- Average rent for a 2-bedroom in Toronto = $3,200/month

- Property taxes (~$500/month) + Utilities (~$300/month)

- Your net cost to live in a multi-unit home = just over $3K/month

(That’s not a whole lot more than renting a 1-bedroom condo at $2,500/month while paying someone else’s mortgage!)

We don’t expect this window of opportunity to last long. If you’re serious about getting into the market before prices rise again, let’s chat and put a plan in place.

Reply to this email or DM us now—we’ll guide you every step of the way!

Attention High School Grads & Proud Parents!

Did you know that as a past or current client of our brokerage, your child could be eligible for a RE/MAX Hallmark scholarship?

Since 2007, our scholarship program has helped students achieve their post-secondary dreams, awarding over $220,000 in funding!

If your child is heading into their first year of college or university this fall, this is a golden opportunity to receive financial support.

Deadline to apply: April 30, 2025

Scholarship funds will be shared among selected applicants

Let’s make those tuition bills a little lighter! If you have any questions or need an application, reach out today!

*Terms and conditions apply

We’re Here To Help!

As always, we would be happy to help you and any of your friends, family, colleagues, or neighbours with real estate services or advice. If you can think of anyone who could use our help, feel free to make an introduction! We promise we’ll make you look good ?

Cheers!

Chris and Ford