June 2024 Market Report

Hey Friends!

Summer is almost here!

Summer just happens to be the favourite season for the TO Group.

We absolutely love summer and we wait all year for the warm weather and long fun-filled days.

A few of the many things we love about summer:

- Ford and Chris just happen to both have birthdays in July

- Beach Volleyball

- (more) Jays games

- Golf

- An ice cold beer (or two) on one of Toronto’s many patios

Enough about us, let’s take a few minutes to give you another real estate update for June 2024

After what feels like months of waiting, the Bank of Canada has made their first decrease in the overnight lending rate. With a collective sigh of relief from many, the BoC decreased the rate by 0.25% on Wednesday to sit at 4.75%. While the decrease won’t have a huge effect on affordability, it is a sign that things are starting to move in the right direction.

Many expect the initial drop in rates to result in more decreases over the next year or so (possibly adding up to 1.5%).

Generally speaking, there is usually a bit of a delay before we start to see these changes take place in the market, so we’ll see how quickly things unfold over the next few months.

So what does this mean? Well, if you have a variable mortgage for $1,000,000 (using round numbers), your monthly savings will be approximately $155 with the decrease of 0.25% to the overnight rate. It sure doesn’t seem like a lot, but it all adds up! If anything, this will likely start to give buyers a bit more confidence in Toronto real estate and they will likely enter the market. Often when we see more buyers enter the market, we see more competition, and we see price increases.

If you have been waiting to purchase your first home, or an investment property, now could be a great time to put your plan into action! The rate cuts are good news for many and there are currently plenty of great opportunities out there that we don’t expect will last very long.

This could be one of the best times to purchase a home in the last few years. Reach out at any time to chat about what this could mean for you!

As the warm weather comes, the real estate market tends to slow. People start to focus their attention on summer vacations vs. buying their next home. This is exactly what we saw happen as May transitioned into June.

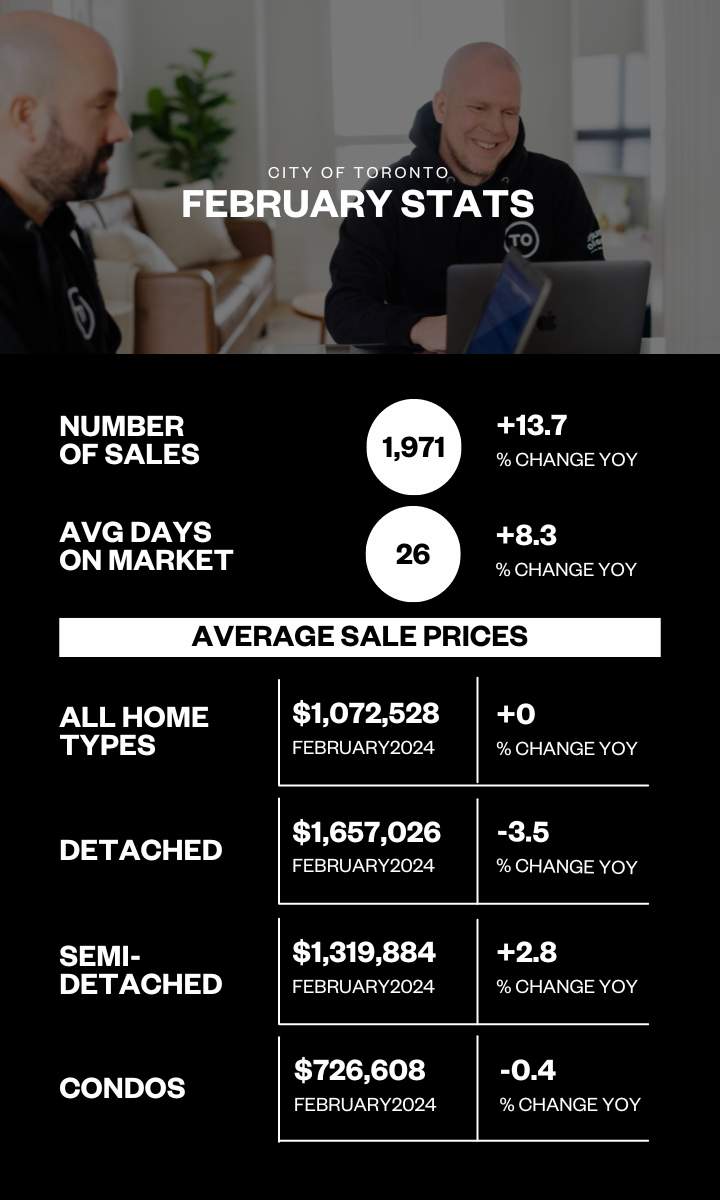

Overall, prices in the city of Toronto stayed relatively flat comparing May 2024 to May 2023, coming in 0.3% lower than the previous year. The biggest change that we saw was the decrease in sales by 17.8% year-over-year. Even more interesting is that new listings in the GTA were up 21% over the same time period, meaning that there were many more options to choose from than what buyers are used to. There is plenty of speculation out there as to why this happened, however the most popular opinion is that buyers are waiting for rates to come down further before going shopping. Many families are getting stretched financially due to inflation and the higher cost of living which doesn’t always align with a move.

We noticed that the freehold market moved more quickly than the condo market, especially if a home was newly renovated and checked all of the boxes. There are plenty of condos to choose from out there, so buyers have ample choice to find their perfect home or investment.

Check out the May year-over-year stats below for more information on the current market. If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

2118 Bloor St W unit 402 is an absolute stunner!

Big, Bright, and Beautiful on Bloor St W! Welcome home to this luxurious retreat at Picnic condos, a boutique building in High Park! This oversized corner unit features a custom floor plan, ample floor to ceiling windows, and is beaming with natural light. The modern kitchen showcases Scavolini cabinetry, high-end european appliances, upgraded gas cooking, and sleek Caesarstone countertops, complete with a breakfast bar. The open concept living space is perfect for entertaining friends and family and includes a walk out to a private balcony featuring a gas line for a BBQ. The Primary retreat boasts a picturesque tree-top view, dual walk through closets with built-in shelving, and a spacious spa-like 4-piece ensuite. Steps to all of the amazing shops, restaurants, cafes on Bloor St W, TTC, and the sprawling 400 acre High Park!

Check out www.2118BloorWest.com for more info and photos!

318 King St E unit 801 is one of the best valued condos in Corktown!

Welcome home to boutique urban living at The King East. This Oversized 1-bedroom condo offers the perfect blend of modern comfort and convenience. Enjoy the open concept living space with approx 9′ ceilings and concrete accents for a super cool loft-style feel. Includes a large bedroom with plenty of closet space and natural light. The modern open concept kitchen features full-sized stainless steel appliances (including a gas range), stone countertops, and floor to ceiling windows. This beautiful residence features 600 square feet of awesome in addition to the spacious balcony – complete with a gas line for a BBQ and stunning city views. Within walking distance to everything you need – Distillery District, St. Lawrence Market, George Brown College, parks, some of the best restaurants in the East end of the city. Multiple options for commuter access and TTC – including the future Ontario Line station that will be completed across the street. Move in and enjoy everything that this beautiful residence has to offer.

Check out www.318king.com for more info and photos!

The Bank of Canada has the following rate announcements scheduled for 2024. Interest rates have an integral effect on how our real estate market operates so it will be interesting to see how things unfold as the announcements come.

- Wednesday, July 24

- Wednesday, September 4

- Wednesday, October 23

- Wednesday, December 11

We are looking forward to some summer fun, but keep in mind that the summer real estate market is often full of opportunity. Let’s chat about what opportunities we can find for you!

As always, we would be happy to help you and any of your friends, family, colleagues, or neighbours with real estate services or advice. If you can think of anyone that could use our help, feel free to make an introduction! We promise we’ll make you look good ;)

Cheers!

Chris and Ford