May 2024 Market Report

Hey Friends!

We are EXCITED to feel the warm weather and to see the beautiful trees and flowers blooming throughout the city. Neighbours are hanging out on their front porches again and we can’t help but notice that more people are smiling ?

The real estate market is active and homes are being bought and sold.

Let’s take a few minutes to give you another Real Estate update for May 2024.

The Government of Canada dropped a bit of a surprise on us all a couple of weeks ago in relation to Capital Gains Taxes in Canada. This resulted in a bit of a worried frenzy among investors, financial planners, and accountants. The toughest blow is that they aren’t giving our citizens much time to change their plans that have likely been in place for years.

In relation to real estate, if you dispose of your capital property that is NOT your principal residence, the current rule states that 50% of the gain is included in your taxable income.

The new proposed rule will be that 66.7% of the gain will be included in your taxable income, if the property is disposed of on or after June 25, 2024.

There are some differences between individuals vs. corporations and trusts. For individuals, the first $250,000 of a capital gain realized after June 25, 2024 will be taxed at 50% and anything over and above that will be taxed at 67.7%

We are seeing a lot of real estate investors rush to the market looking for a quick sale in order to avoid the increased tax. If you own a secondary property, let’s take some time to do some quick math before making a snap-decision.

Assuming that you are in the highest tax bracket at 53.53%, a capital gain of $350,000 would result in a difference of approximately $9,000 more out of pocket with the new rules vs. the old ones.

Although it’s not ideal, it’s likely not as bad as it sounds. Where it will have the largest effect will be on people who have held an investment property for more than a decade who have realized a larger gain over time.

Now, don’t freak out! If you had no plans on selling your secondary property, it may not make sense to get it sold before June 25, 2024 (or maybe not even this year at all!). If it was on your radar to sell it this year, it may be worth getting it on the market and sold before June 25.

Just reach out! We are here to help you walk through all of your options. It would also be a great idea to touch base with your accountant and/or financial planner :)

Remember, teamwork makes your real estate dream work!

The Buyers are out and the Sellers are more willing to list their homes for sale after seeing prices bounce back after the brief dip caused by the hikes in interest rates. April came and went and interest rates stayed the same. The next rate announcement is June 5th and there is plenty of anticipation on whether or not the Bank of Canada will start to drop the interest rates. We’re sure that a drop in rates would be welcome by many!

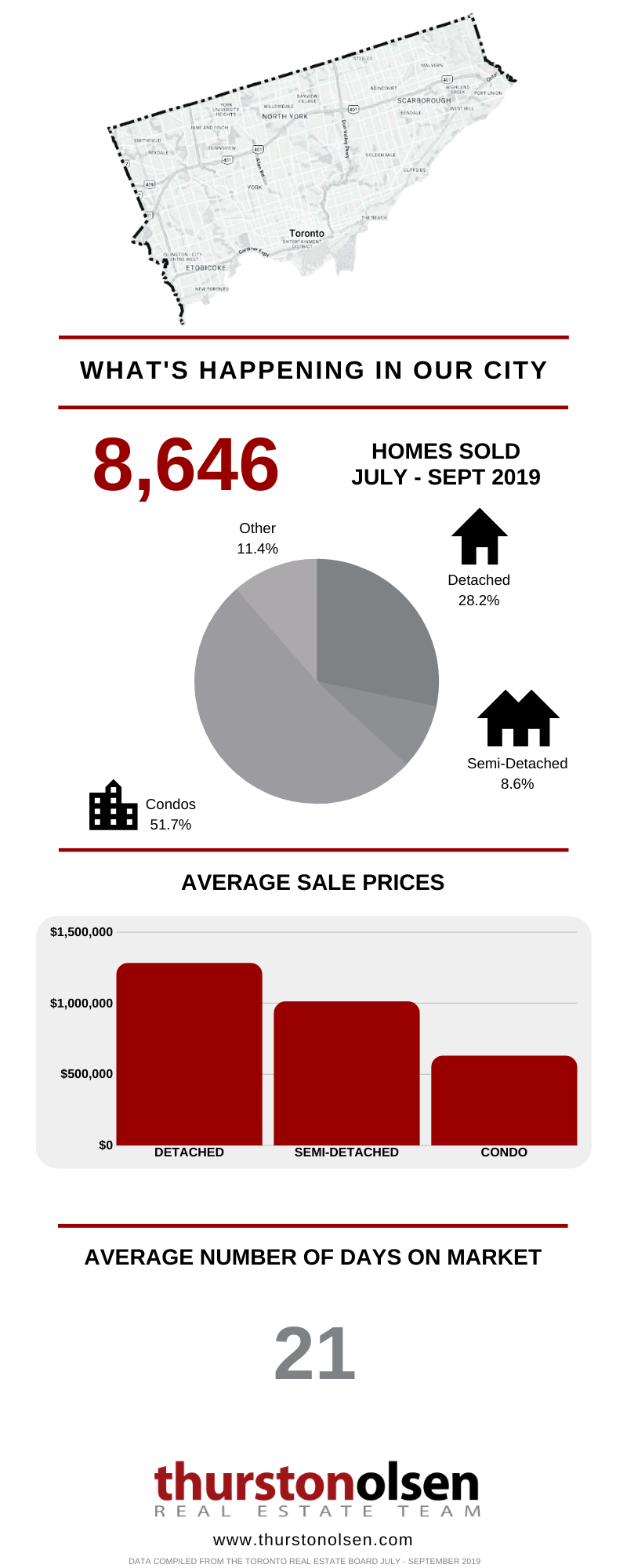

Year-over-year stats were relatively flat with slight increases of approximately 3% overall in the city of Toronto. We did however see a 6% increase in all home types in the city of Toronto comparing March/24 to April/24, which is not uncommon for a traditional spring market.

The number of sales were also down year-over-year which meant increased choice for buyers. This and an increased number of available listings has also helped to keep the prices flat.

Freehold homes continue to get more attention than the condo market, garnering more multiple offer situations and quicker sales. As always, a properly presented and priced property will still move in almost any market (we can help with this!)

Overall, we feel that this is a relatively healthy market and there isn’t as much tension compared to spring markets in recent years – a much more enjoyable experience for buyers and sellers.

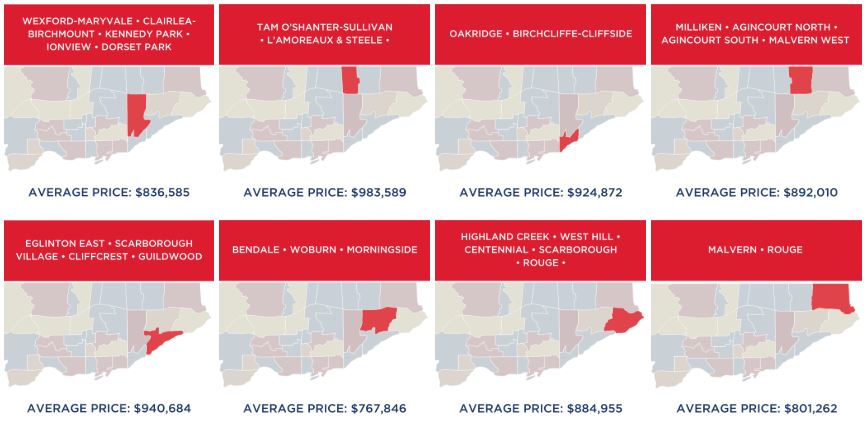

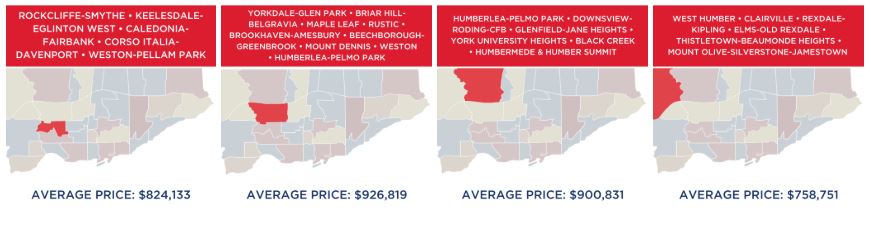

Check out the April year-over-year stats below for more information on the current market. If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

Welcome home to boutique urban living at unit 801 at 318 King St E, The King East, where style meets comfort in this impressive one bedroom condo. This residence offers an inviting open-concept living space with engineered hardwood floors, approximately 9-foot ceilings and stylish concrete accents, evoking a trendy loft-style ambiance.

The modern kitchen features full-sized stainless steel appliances, sleek stone countertops and a new subway tile backsplash. Floor-to-ceiling windows fill the space with natural light throughout the day with spectacular sunsets to follow in the evening.

The spacious bedroom boasts large closets for plenty of storage, engineered hardwood floors and frosted glass sliding doors.

Spanning 600 square feet of wonderful living space inside, this residence also features a generously sized balcony with the convenience of a gas BBQ, perfect for outdoor dining, entertaining friends or simply unwinding while taking in the city views.

Suite 801 also includes the added convenience of ensuite laundry, a large front hall closet and a locker.

Check out www.318king.com for more info and photos.

We have been blessed to have had the opportunity to help many of you and your people so far this year.

We truly appreciate your support and feel extremely honoured that you choose The TO Group to refer to your family, friends, and colleagues. Thank you!

Cheers!

Chris and Ford

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FHMGGYM7GZDXLGEMZSNJQTI5DE.JPG)

“Many home buyers who had initially moved to the sidelines due to the Ontario Fair Housing Plan and new mortgage lending guidelines have renewed their search for a home and are getting deals done much more so than last year,” Garry Bhaura, president at the housing board, said in a statement.

“Many home buyers who had initially moved to the sidelines due to the Ontario Fair Housing Plan and new mortgage lending guidelines have renewed their search for a home and are getting deals done much more so than last year,” Garry Bhaura, president at the housing board, said in a statement.