February 2026 Market Report

February 2026 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

February is when the market starts to wake up. The initial pause of the new year is behind us, conversations are getting more serious, and we’re seeing early signs of activity from buyers and sellers who are planning ahead for spring.

We’re heading into the rest of 2026 feeling encouraged by the momentum building across the city, and grateful for the trust and conversations we continue to have with so many of you. Whether it’s long-term planning, early prep, or just keeping a close eye on the numbers, this is a month where clarity really matters.

The Toronto market is offering opportunities for those paying attention. Strategy, timing, and preparation are becoming increasingly important as confidence slowly builds.

Here’s your February 2026 Market Update. Let’s keep moving forward with clarity and confidence.

Has Home Ownership In Toronto Become More Affordable?

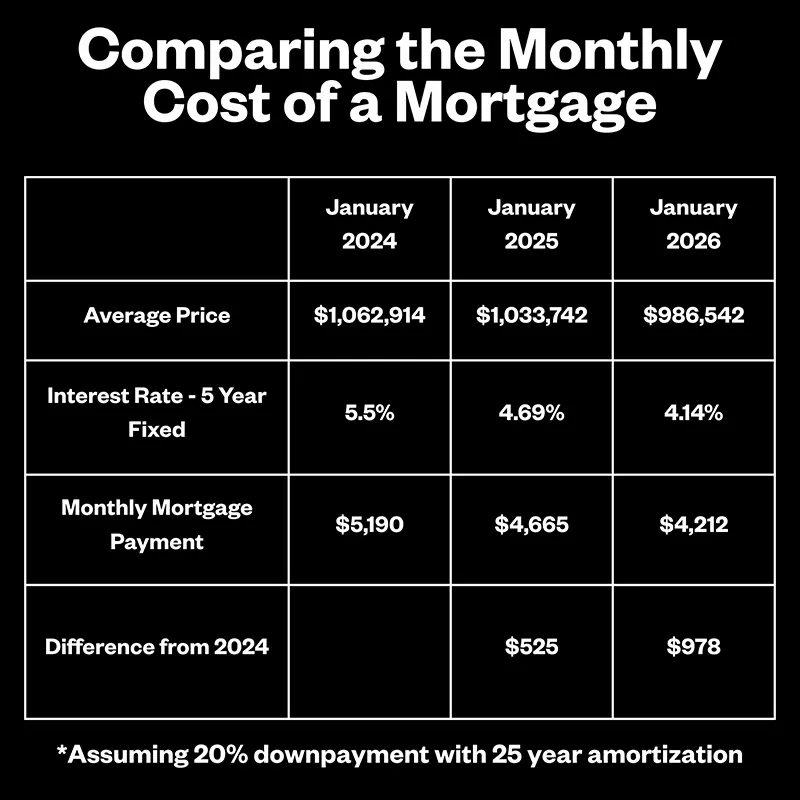

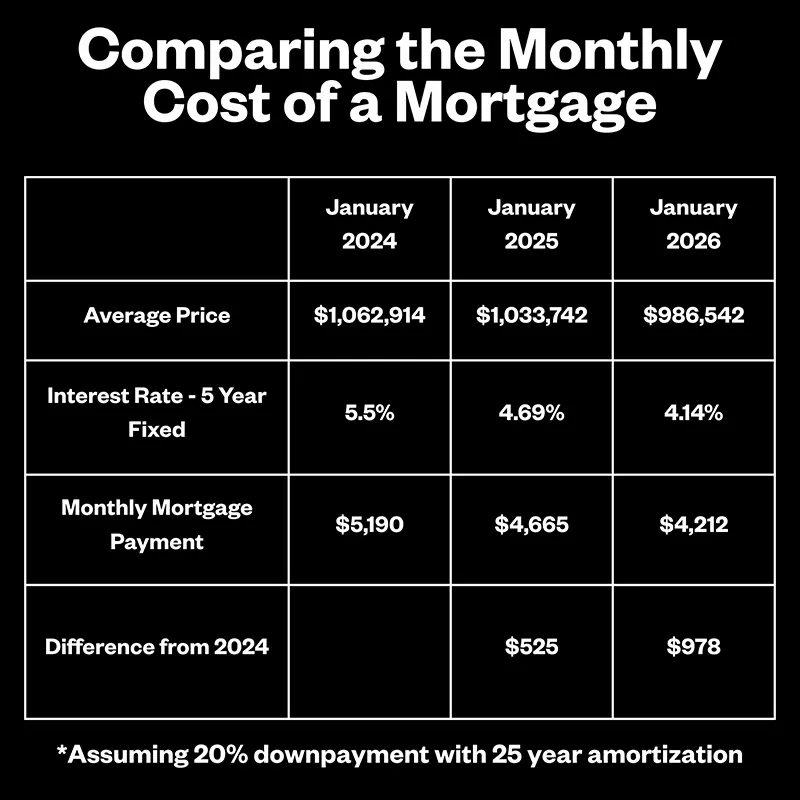

Since the start of 2024, we’ve seen something Toronto buyers haven’t enjoyed in a while: prices and mortgage rates moving in the right direction at the same time. Average home prices are meaningfully lower than their peak, and mortgage rates have come down from the highs we were dealing with just a couple of years ago.

The average home price has dropped from about $1.06M in 2024 to just under $987K in early 2026, while 5-year fixed mortgage rates have eased from 5.5% down to roughly 4.14%. When those two forces work together, monthly payments shrink in a meaningful way.

Here’s the real-world impact:

A typical monthly mortgage payment has fallen from about $5,190 in January 2024 to roughly $4,212 today. That’s nearly $1,000 per month less than what buyers were facing just two years ago, and about $525/month cheaper than January 2025.

That’s not pocket change. That’s daycare money, investment money, or “still enjoying life while owning a home” money.

Now, we recognize that the cost of living in other areas of life may have increased, but at least the cost of home ownership has improved – a highly debated topic that has been at the top of people’s complaint lists for many recent years!

What We Are Seeing From the Field

At a headline level, the market looks calmer than this time last year. Sales are down, average prices are softer, and the pace feels more measured overall. But zoom in, and the story changes quickly.

In well-priced, well-prepared homes, we’re still seeing, in some cases, multiple offers, bully offers, packed showings, and sales well above the asking price. On the other hand, homes that entered the market without a clear strategy are sitting longer, offer nights come and go, and some listings are quietly being re-listed after missing the mark.

This creates a uniquely opportunistic market. Buyers who are prepared and decisive can find real leverage in quieter segments, while sellers who invest in preparation can still generate strong competition and premium results. In today’s market, strong pricing, preparation, and marketing are what separate Sold from Stalled.

Check out the January year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

Vacant Home Tax – Don’t Forget To Declare!

(Yes, We Have To Do This Every Year)

Toronto homeowners, it’s that time of year again! The Vacant Home Tax (VHT) declaration deadline is fast approaching, and even if you live in your home, you still need to file (don’t forget any rental properties)!

Failing to make the declaration by April 30th could result in penalties or even having your home mistakenly classified as vacant, leading to an unexpected tax bill. Yikes!

The tax is now 3% of your current assessed tax value, so if your home was assessed at $800,000 you could be on the hook for $24,000 in tax!

*Keep in mind that MPAC generally uses an assessed value much lower than what your home is actually worth – this info should be on your final tax bill.

Not sure how to complete your declaration? No worries, we’ve got your back! Whether you need a quick rundown on the process or have questions about potential exemptions, reach out anytime, and let’s make sure you avoid any unnecessary surprises.

Help Us, Help Others!

We’re incredibly thankful for the referrals you send our way. They make up a big part of our business. This year, on top of that usual support, we’re aiming to help 12 additional families with buying or selling in Toronto.

If anyone comes to mind who could use some guidance, we’d be honoured by an introduction. We promise to take great care of them (and make you look good ?).

Have a great month!

Chris and Ford

January 2026 Market Report

January 2026 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

Somehow, just like that, we’re stepping into January and welcoming a brand-new year. The holiday glow may be fading, but there’s something energizing about clean calendars, fresh goals, and that unmistakable “new year, new possibilities” feeling.

As we look ahead to 2026, we’re feeling incredibly optimistic. Last year reminded us how powerful community can be. From helping families start new chapters, to welcoming new neighbours, and reconnecting with so many of you at events, open houses, and everyday check-ins. Those moments are what make this work so meaningful, and we’re so grateful to head into another year with such an amazing community around us.

And of course, the Toronto market is already giving us plenty to watch. January brings reflection, strategy, and early opportunities for those thinking ahead. Whether you’re planning a move this year or simply keeping an eye on what’s next, staying informed and intentional will be key.

Here’s your January 2026 Market Update. Let’s kick off the year with clarity, confidence, and a little excitement for what’s ahead.

What Are Your 2026 Real Estate Goals?

A new year is the perfect time to reflect, reset, and look ahead. Whether you love setting goals or prefer to keep things flexible, if real estate is on your mind in 2026, we’re here to help.

Maybe your family is growing and you’re ready for more space.

Maybe the kids have flown the nest and it’s time to right-size.

Maybe you’re dreaming of owning your first home and building equity for your future.

Or maybe you’re curious about investing and creating long-term wealth through real estate.

Whatever stage you’re in, our goal is to make the process clear, strategic, and as stress-free as possible.

Even if your plans are a few years out, we’re always happy to start with a casual, no-obligation conversation so you’re set up for success when the time is right.

Let’s make 2026 a year of smart moves and exciting possibilities.

What We Are Seeing From the Field

Real estate in December tends to take a slower approach. Buyers and Sellers often put their real estate needs on hold, so that they can focus their time with family and friends, while recharging after a busy year.

The TO Group always takes time to reflect on all of the successes and challenges from the year prior. This allows us to improve our services and come back stronger in the new year to support our awesome clients (old and new!).

2025 was an interesting market. Expectations were optimistic out of the gate, however some economic uncertainties created a bit of a roller coaster effect as we moved through the year.

For the month of December, Toronto home sales actually increased compared to December 2024, which was nice to see. However, with more listings on the market, buyers had greater negotiating power, leading to lower selling prices and improved affordability. For the month, new listings increased by 9.4% and the average selling price fell 4.6% to approximately $986K.

Lower prices and easing mortgage rates have helped set the stage for a potential market recovery. As confidence in the economy and job market improves, pent-up demand is expected to drive increased activity in the months ahead.

Check out the December year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

We’re Here To Help!

As we head into 2026, here’s one thing we want you to know:

Our work is rooted in service. If someone you know could benefit from clear, honest real estate guidance, please keep us in mind and pass along our info. Friends, family, neighbours, colleagues, etc. We’re always here to help them navigate the market with confidence (and while having a little bit of fun along the way).

And if you’re thinking of making a move in 2026, now’s the perfect time to chat through a plan. A little prep as the new year begins can set you up beautifully for the market.

Wishing you health, happiness, and success in 2026!

Chris and Ford

February 2026 Market Report

February 2026 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

February is when the market starts to wake up. The initial pause of the new year is behind us, conversations are getting more serious, and we’re seeing early signs of activity from buyers and sellers who are planning ahead for spring.

We’re heading into the rest of 2026 feeling encouraged by the momentum building across the city, and grateful for the trust and conversations we continue to have with so many of you. Whether it’s long-term planning, early prep, or just keeping a close eye on the numbers, this is a month where clarity really matters.

The Toronto market is offering opportunities for those paying attention. Strategy, timing, and preparation are becoming increasingly important as confidence slowly builds.

Here’s your February 2026 Market Update. Let’s keep moving forward with clarity and confidence.

Has Home Ownership In Toronto Become More Affordable?

Since the start of 2024, we’ve seen something Toronto buyers haven’t enjoyed in a while: prices and mortgage rates moving in the right direction at the same time. Average home prices are meaningfully lower than their peak, and mortgage rates have come down from the highs we were dealing with just a couple of years ago.

The average home price has dropped from about $1.06M in 2024 to just under $987K in early 2026, while 5-year fixed mortgage rates have eased from 5.5% down to roughly 4.14%. When those two forces work together, monthly payments shrink in a meaningful way.

Here’s the real-world impact:

A typical monthly mortgage payment has fallen from about $5,190 in January 2024 to roughly $4,212 today. That’s nearly $1,000 per month less than what buyers were facing just two years ago, and about $525/month cheaper than January 2025.

That’s not pocket change. That’s daycare money, investment money, or “still enjoying life while owning a home” money.

Now, we recognize that the cost of living in other areas of life may have increased, but at least the cost of home ownership has improved – a highly debated topic that has been at the top of people’s complaint lists for many recent years!

What We Are Seeing From the Field

At a headline level, the market looks calmer than this time last year. Sales are down, average prices are softer, and the pace feels more measured overall. But zoom in, and the story changes quickly.

In well-priced, well-prepared homes, we’re still seeing, in some cases, multiple offers, bully offers, packed showings, and sales well above the asking price. On the other hand, homes that entered the market without a clear strategy are sitting longer, offer nights come and go, and some listings are quietly being re-listed after missing the mark.

This creates a uniquely opportunistic market. Buyers who are prepared and decisive can find real leverage in quieter segments, while sellers who invest in preparation can still generate strong competition and premium results. In today’s market, strong pricing, preparation, and marketing are what separate Sold from Stalled.

Check out the January year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

Vacant Home Tax – Don’t Forget To Declare!

(Yes, We Have To Do This Every Year)

Toronto homeowners, it’s that time of year again! The Vacant Home Tax (VHT) declaration deadline is fast approaching, and even if you live in your home, you still need to file (don’t forget any rental properties)!

Failing to make the declaration by April 30th could result in penalties or even having your home mistakenly classified as vacant, leading to an unexpected tax bill. Yikes!

The tax is now 3% of your current assessed tax value, so if your home was assessed at $800,000 you could be on the hook for $24,000 in tax!

*Keep in mind that MPAC generally uses an assessed value much lower than what your home is actually worth – this info should be on your final tax bill.

Not sure how to complete your declaration? No worries, we’ve got your back! Whether you need a quick rundown on the process or have questions about potential exemptions, reach out anytime, and let’s make sure you avoid any unnecessary surprises.

Help Us, Help Others!

We’re incredibly thankful for the referrals you send our way. They make up a big part of our business. This year, on top of that usual support, we’re aiming to help 12 additional families with buying or selling in Toronto.

If anyone comes to mind who could use some guidance, we’d be honoured by an introduction. We promise to take great care of them (and make you look good ?).

Have a great month!

Chris and Ford

January 2026 Market Report

January 2026 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

Somehow, just like that, we’re stepping into January and welcoming a brand-new year. The holiday glow may be fading, but there’s something energizing about clean calendars, fresh goals, and that unmistakable “new year, new possibilities” feeling.

As we look ahead to 2026, we’re feeling incredibly optimistic. Last year reminded us how powerful community can be. From helping families start new chapters, to welcoming new neighbours, and reconnecting with so many of you at events, open houses, and everyday check-ins. Those moments are what make this work so meaningful, and we’re so grateful to head into another year with such an amazing community around us.

And of course, the Toronto market is already giving us plenty to watch. January brings reflection, strategy, and early opportunities for those thinking ahead. Whether you’re planning a move this year or simply keeping an eye on what’s next, staying informed and intentional will be key.

Here’s your January 2026 Market Update. Let’s kick off the year with clarity, confidence, and a little excitement for what’s ahead.

What Are Your 2026 Real Estate Goals?

A new year is the perfect time to reflect, reset, and look ahead. Whether you love setting goals or prefer to keep things flexible, if real estate is on your mind in 2026, we’re here to help.

Maybe your family is growing and you’re ready for more space.

Maybe the kids have flown the nest and it’s time to right-size.

Maybe you’re dreaming of owning your first home and building equity for your future.

Or maybe you’re curious about investing and creating long-term wealth through real estate.

Whatever stage you’re in, our goal is to make the process clear, strategic, and as stress-free as possible.

Even if your plans are a few years out, we’re always happy to start with a casual, no-obligation conversation so you’re set up for success when the time is right.

Let’s make 2026 a year of smart moves and exciting possibilities.

What We Are Seeing From the Field

Real estate in December tends to take a slower approach. Buyers and Sellers often put their real estate needs on hold, so that they can focus their time with family and friends, while recharging after a busy year.

The TO Group always takes time to reflect on all of the successes and challenges from the year prior. This allows us to improve our services and come back stronger in the new year to support our awesome clients (old and new!).

2025 was an interesting market. Expectations were optimistic out of the gate, however some economic uncertainties created a bit of a roller coaster effect as we moved through the year.

For the month of December, Toronto home sales actually increased compared to December 2024, which was nice to see. However, with more listings on the market, buyers had greater negotiating power, leading to lower selling prices and improved affordability. For the month, new listings increased by 9.4% and the average selling price fell 4.6% to approximately $986K.

Lower prices and easing mortgage rates have helped set the stage for a potential market recovery. As confidence in the economy and job market improves, pent-up demand is expected to drive increased activity in the months ahead.

Check out the December year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

We’re Here To Help!

As we head into 2026, here’s one thing we want you to know:

Our work is rooted in service. If someone you know could benefit from clear, honest real estate guidance, please keep us in mind and pass along our info. Friends, family, neighbours, colleagues, etc. We’re always here to help them navigate the market with confidence (and while having a little bit of fun along the way).

And if you’re thinking of making a move in 2026, now’s the perfect time to chat through a plan. A little prep as the new year begins can set you up beautifully for the market.

Wishing you health, happiness, and success in 2026!

Chris and Ford