Toronto home prices rise further in 2019

The city can “expect further acceleration” if nothing is done about the city’s undersupply of new homes, TREB says.

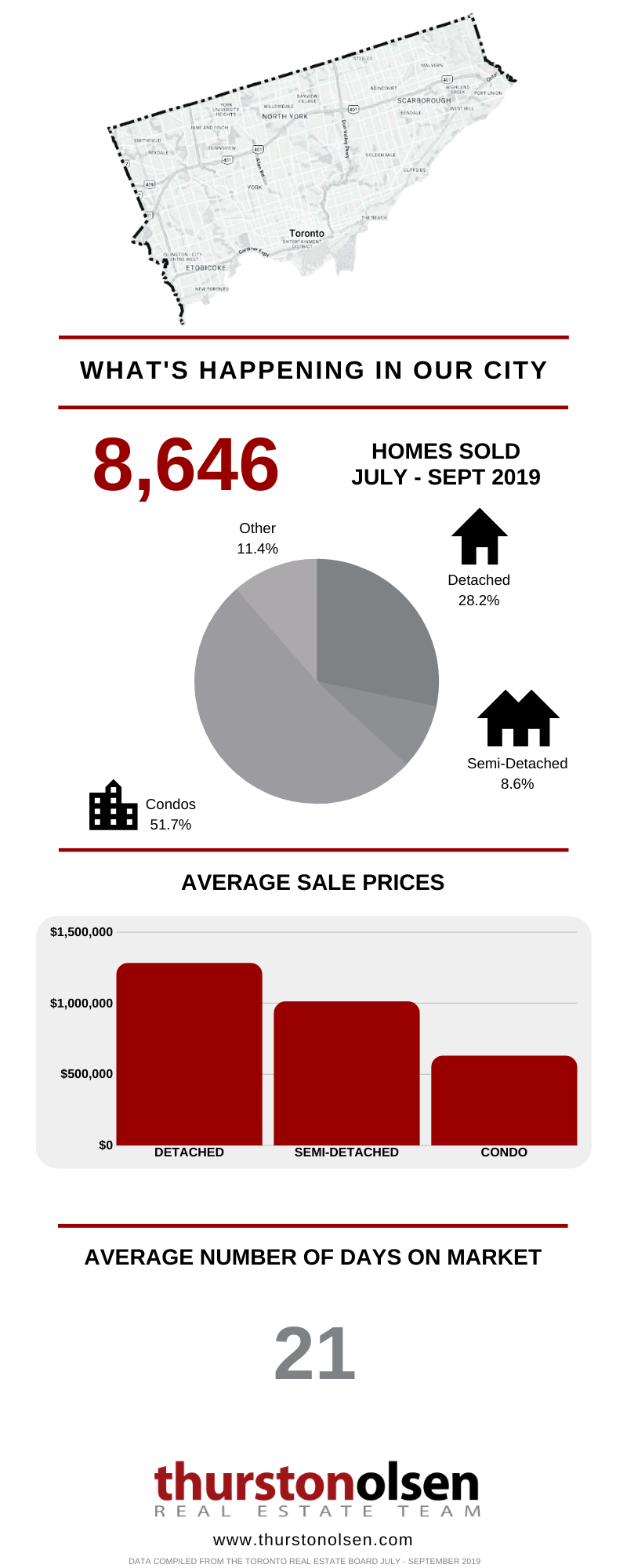

The Toronto Real Estate Board says home sales were up 17.4 per cent in December compared with the same month last year, while the average price was up almost 12 per cent in the month from a year earlier.

The December jump caps a surge in activity in the second half of last year, while a slower first half meant that overall 2019 sales were in line with annual medians for the decade.

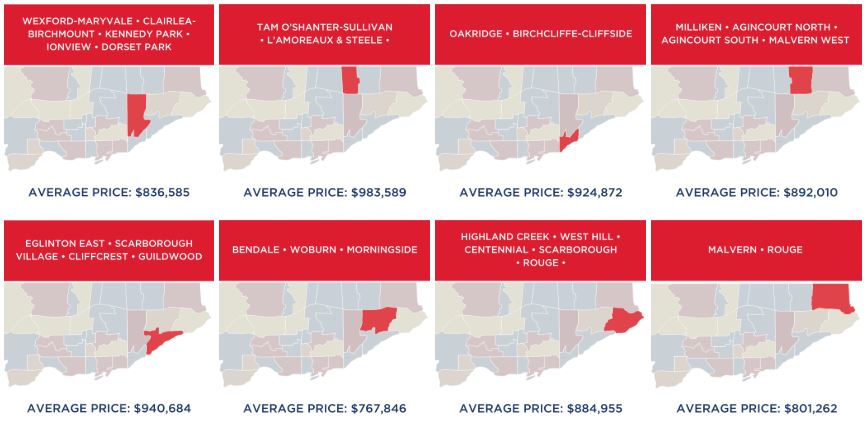

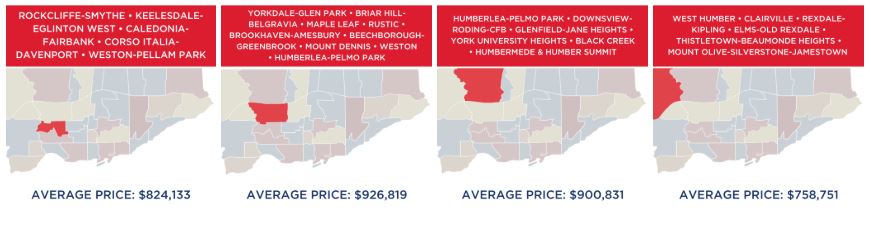

The increased sales over 2018, even as new listings dropped 2.4 per cent year-over-year, helped push the average selling price for the year up by four per cent to $819,319. The average selling price in December was $837,788, up 11.9 per cent from a year earlier.

“We certainly saw a recovery in sales activity in 2019, particularly in the second half of the year,” said Michael Collins, president of the Toronto Real Estate Board (TREB).

“As anticipated, many home buyers who were initially on the sidelines moved back into the market place starting in the spring. Buyer confidence was buoyed by a strong regional economy and declining contract mortgage rates over the course of the year.”

The region continues to struggle with an undersupply of housing, said Jason Mercer, TREB’s chief market analyst.

“Taking 2019 as an example, we experienced a strong sales increase up against a decline in supply. Tighter market conditions translated into accelerating price growth. Expect further acceleration in 2020 if there is no relief on the supply front,” he said in a statement.

For the year, condos saw the biggest price gains, up 6.4 per cent to an average of $587,959 compared with 2018, while detached home prices were up 0.9 per cent to an average of $1.02 million compared with the previous year. Condo sales activity was up only three per cent overall last year, while detached home sales were up 18.8 per cent.

For December, detached homes actually recorded higher price gains, up 11.6 per cent in the month to $1.05 million as sales were up 26.2 per cent from a year earlier. The average condo price was up 10.4 per cent to $612,464, while sales were up 6.9 per cent.

source – The Canadian Press, with a file from HuffPost Canada

Have questions about Toronto home prices? Contact Us.