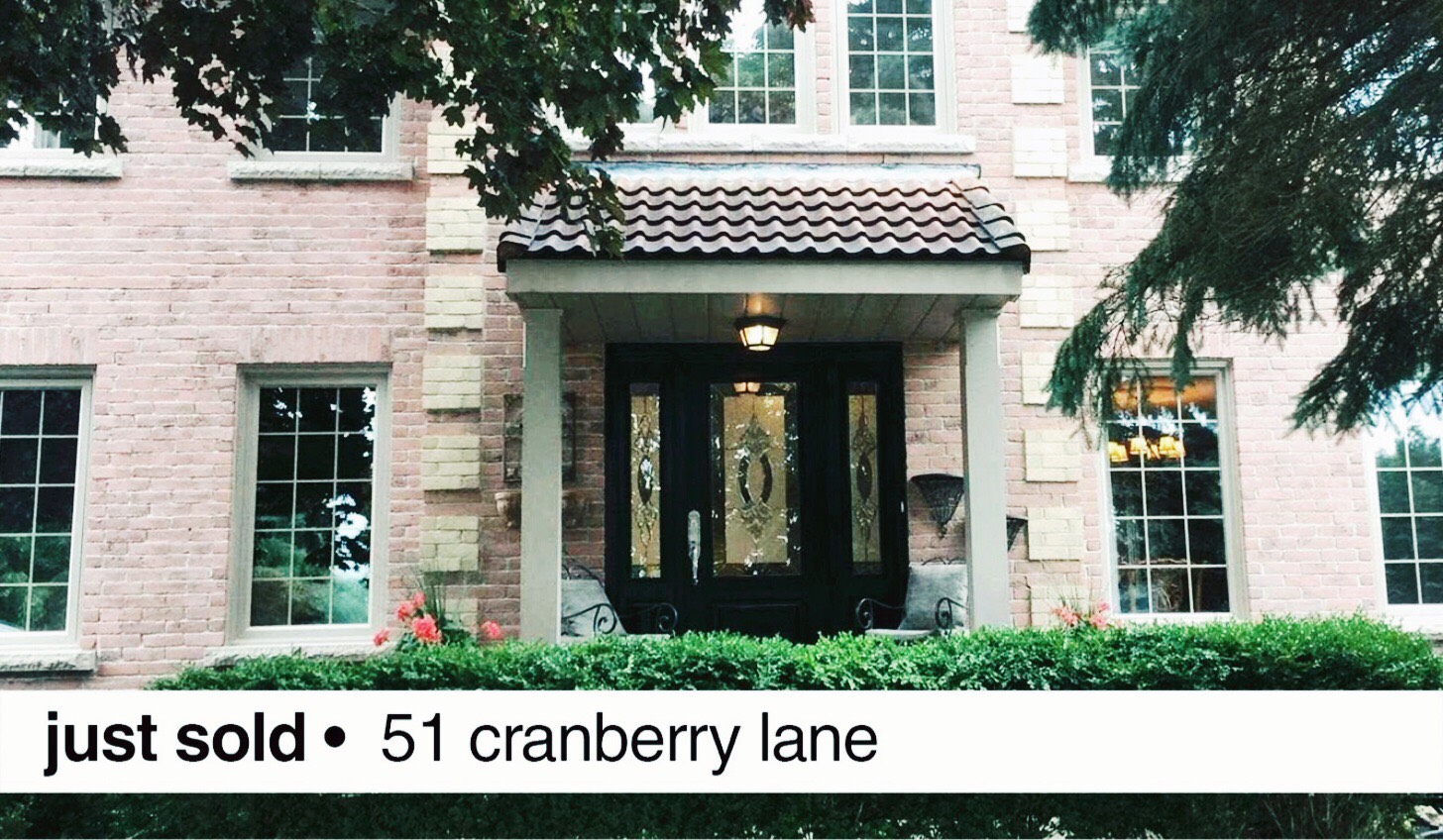

SOLD! 1410 Dupont Street Loft 312 – Wallace Emerson

Through a whirlwind of showings, Loft 312 at 1410 Dupont Street sold in ONE DAY! Congratulations to our client who is moving onto a new adventure, we’re so happy for you. We’re also excited for the buyer to make this unique space their own and enjoy it well into the future.

This 626 square foot loft is situated within the original part of a century-old brick warehouse once owned by General Electric.

The modern kitchen features granite counters, a breakfast bar and stainless steel appliances. Overlooking the open concept living and dining rooms, it’s perfect for entertaining!

The living and dining areas are equally impressive with plenty of natural light through the south facing skylights. The space is further enhanced by exposed ductwork, trendy light flooring and enough room for a home office!

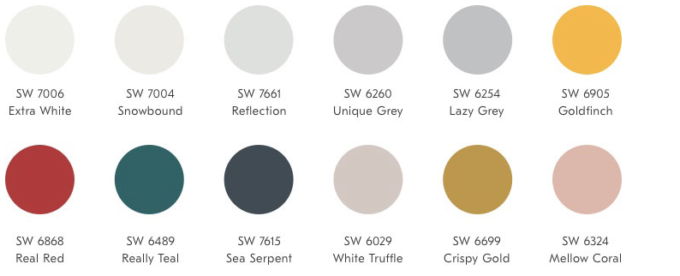

The master bedroom is a wonderful space with large south facing windows and a walk-in closet! The washroom is equally as impressive with modern finishes and neutral tones throughout.

Loft 312 is move in ready and even includes parking.

The building has fantastic amenities including an impressive rooftop patio conveniently located right down the hall and there are so many great shops, cafes and restaurants all within walking distance!

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FHMGGYM7GZDXLGEMZSNJQTI5DE.JPG)