LEASED! 875 Queen Street East Suite 324 – Leslieville

We helped our client successfully rent out his shiny new condo at 875 Queen Street East in Leslieville.

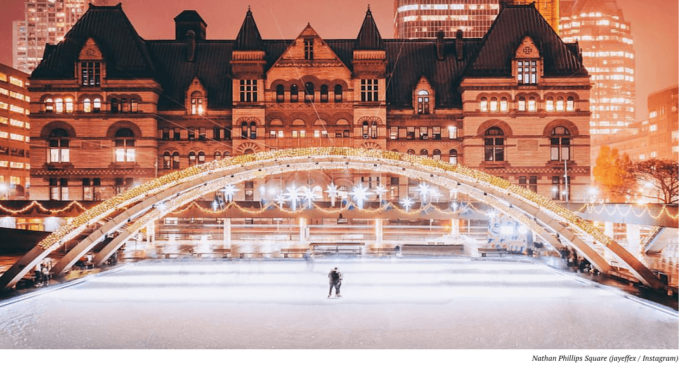

The south east facing corner suite has one bedroom, plus a den. Ample natural light floods the open living room and sleek designer kitchen with lofty concrete ceilings. Steps to parks, restaurants, shops, TTC, easy access to the highways, and all that Leslieville has to offer – plus a parking space!

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FHMGGYM7GZDXLGEMZSNJQTI5DE.JPG)