February 2026 Market Report

February 2026 Newsletter

Thurston Olsen Real Estate Group

Hey Friends!

February is when the market starts to wake up. The initial pause of the new year is behind us, conversations are getting more serious, and we’re seeing early signs of activity from buyers and sellers who are planning ahead for spring.

We’re heading into the rest of 2026 feeling encouraged by the momentum building across the city, and grateful for the trust and conversations we continue to have with so many of you. Whether it’s long-term planning, early prep, or just keeping a close eye on the numbers, this is a month where clarity really matters.

The Toronto market is offering opportunities for those paying attention. Strategy, timing, and preparation are becoming increasingly important as confidence slowly builds.

Here’s your February 2026 Market Update. Let’s keep moving forward with clarity and confidence.

Has Home Ownership In Toronto Become More Affordable?

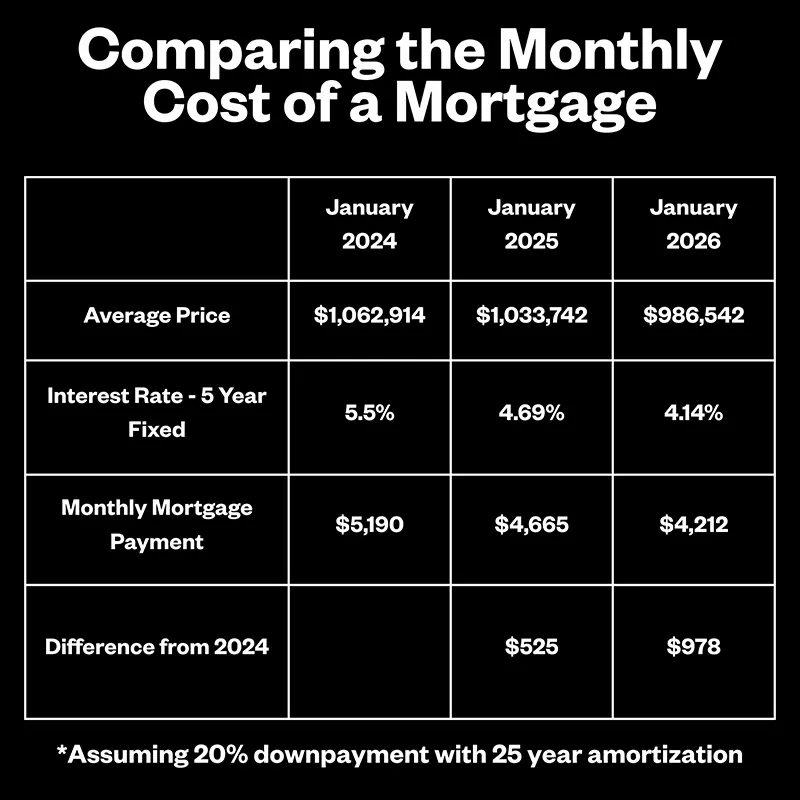

Since the start of 2024, we’ve seen something Toronto buyers haven’t enjoyed in a while: prices and mortgage rates moving in the right direction at the same time. Average home prices are meaningfully lower than their peak, and mortgage rates have come down from the highs we were dealing with just a couple of years ago.

The average home price has dropped from about $1.06M in 2024 to just under $987K in early 2026, while 5-year fixed mortgage rates have eased from 5.5% down to roughly 4.14%. When those two forces work together, monthly payments shrink in a meaningful way.

Here’s the real-world impact:

A typical monthly mortgage payment has fallen from about $5,190 in January 2024 to roughly $4,212 today. That’s nearly $1,000 per month less than what buyers were facing just two years ago, and about $525/month cheaper than January 2025.

That’s not pocket change. That’s daycare money, investment money, or “still enjoying life while owning a home” money.

Now, we recognize that the cost of living in other areas of life may have increased, but at least the cost of home ownership has improved – a highly debated topic that has been at the top of people’s complaint lists for many recent years!

What We Are Seeing From the Field

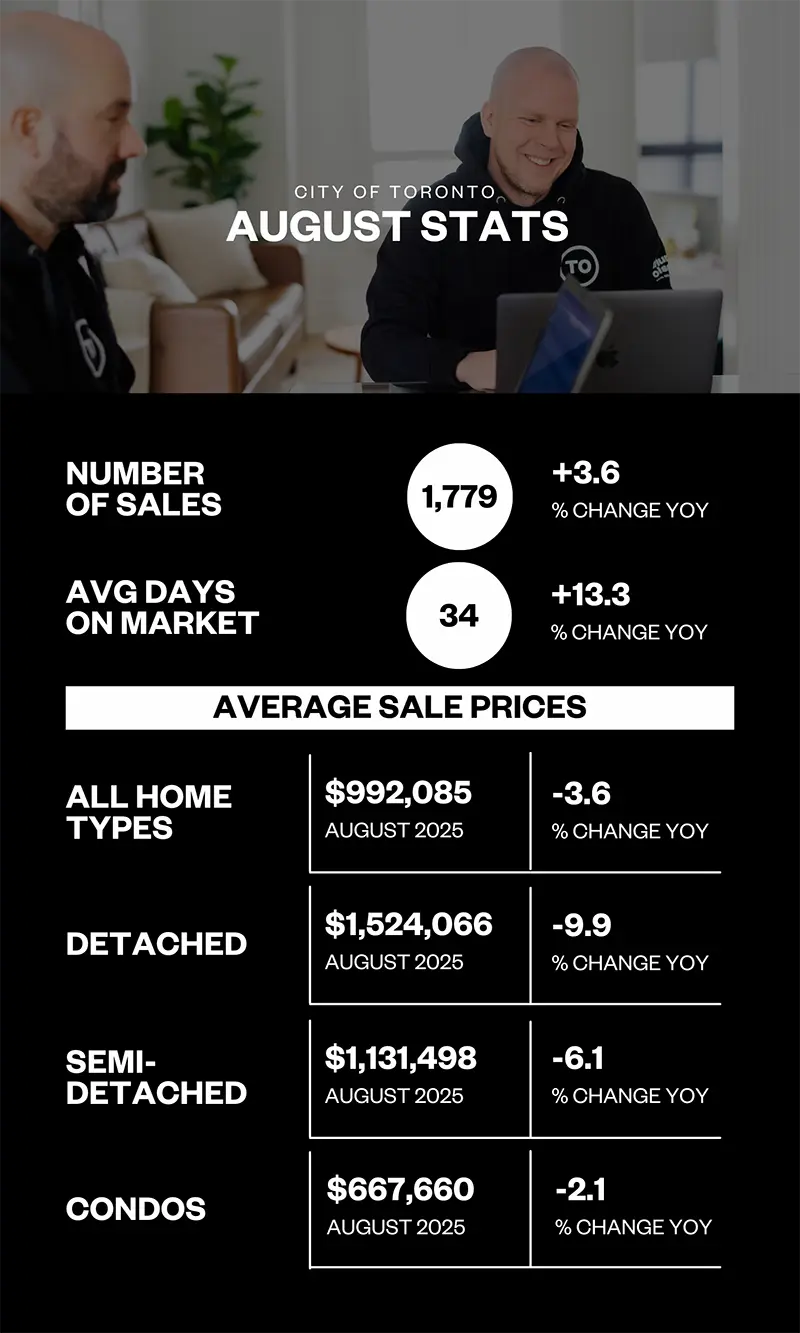

At a headline level, the market looks calmer than this time last year. Sales are down, average prices are softer, and the pace feels more measured overall. But zoom in, and the story changes quickly.

In well-priced, well-prepared homes, we’re still seeing, in some cases, multiple offers, bully offers, packed showings, and sales well above the asking price. On the other hand, homes that entered the market without a clear strategy are sitting longer, offer nights come and go, and some listings are quietly being re-listed after missing the mark.

This creates a uniquely opportunistic market. Buyers who are prepared and decisive can find real leverage in quieter segments, while sellers who invest in preparation can still generate strong competition and premium results. In today’s market, strong pricing, preparation, and marketing are what separate Sold from Stalled.

Check out the January year-over-year stats below for more information on the current market.

If you would like statistics specific to your neighbourhood, an updated Comparative Market Analysis for your home, or help deciphering what the numbers could mean for you, please let us know and we would be happy to provide that for you.

Vacant Home Tax – Don’t Forget To Declare!

(Yes, We Have To Do This Every Year)

Toronto homeowners, it’s that time of year again! The Vacant Home Tax (VHT) declaration deadline is fast approaching, and even if you live in your home, you still need to file (don’t forget any rental properties)!

Failing to make the declaration by April 30th could result in penalties or even having your home mistakenly classified as vacant, leading to an unexpected tax bill. Yikes!

The tax is now 3% of your current assessed tax value, so if your home was assessed at $800,000 you could be on the hook for $24,000 in tax!

*Keep in mind that MPAC generally uses an assessed value much lower than what your home is actually worth – this info should be on your final tax bill.

Not sure how to complete your declaration? No worries, we’ve got your back! Whether you need a quick rundown on the process or have questions about potential exemptions, reach out anytime, and let’s make sure you avoid any unnecessary surprises.

Help Us, Help Others!

We’re incredibly thankful for the referrals you send our way. They make up a big part of our business. This year, on top of that usual support, we’re aiming to help 12 additional families with buying or selling in Toronto.

If anyone comes to mind who could use some guidance, we’d be honoured by an introduction. We promise to take great care of them (and make you look good ?).

Have a great month!

Chris and Ford