Two Decades Of Steady Price Appreciation In The GTA

Steady average price appreciation over close to two decades makes GTA housing market a global anomaly, says RE/MAX Hallmark

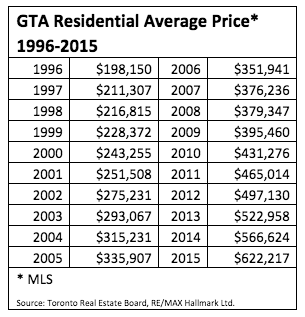

214 per cent increase in real estate values since 1996

Toronto, ON (January 12, 2016) – Low interest rates, coupled with population growth and solid economic fundamentals, contributed to a 214 per cent increase in average residential housing values in the Greater Toronto Area (GTA) over almost two--decades, according to RE/MAX Hallmark Ltd., one of country’s largest real estate franchises.

The GTA housing market is now entering its 20th year of consecutive price appreciation, on the heels of a record--breaking 2015. The market has reported a steady increase in values since 1996, when the cost of an average home in the GTA hovered at $198,150. Average price broke through the $600,000 benchmark in 2015, settling at $622,217 – an increase of 6.21 per cent when compounded annually over the 19--year period.

“The overall strength and stability of Toronto’s housing market is a global anomaly,” says Ken McLachlan, Broker--Owner, RE/MAX Hallmark Ltd. “Very few large residential housing markets can compete with the GTA’s performance over the past two decades”

When analyzing the level of growth in the Greater Toronto Area, population played a serious role. In 2014, the Toronto CMA topped six million (6,055,724), a figure eight per cent higher than the 2011 Census population of 5,583,064 and a substantial 42 per cent uptick over the 1996 Census figure of 4,263,757.

The low interest rate environment has also influenced home buying activity in the GTA. While the average residential mortgage--lending rate for a five--year term hovered at approximately eight per cent in 1996, the same product can be had for under three per cent in today’s competitive market.

Homeownership rates have also steadily increased in the GTA, in spite of rising values. Between 1996 and 2006, the level of ownership jumped approximately 10 per cent in the GTA (58.4 per cent to 67.6 per cent). The most recent available rates for the province of Ontario sat at 71.4 per cent in 2011.

Given the turbulence the GTA market has withstood –recessions, 9/11, and SARS, just to name a few – the performance is “nothing short of remarkable”, explains McLachlan.

“Moving forward, there is no reason to expect the upward trend to end,” says McLachlan. “In light of recent volatility in the stock market and overall economic uncertainty, we anticipate an upswing in home buying activity as investors look to tangible assets like bricks and mortar to ride out the storm. The strength of the US dollar will also contribute, serving as an impetus for greater investment in the Greater Toronto Area throughout 2016.”