How laneway houses could help solve Toronto’s real-estate woes

The GTA housing market has been operating within a policy of intensification for more than a decade now. This has caused a shift away from ground-oriented homes and moved the market toward higher-density housing, such as condominiums.

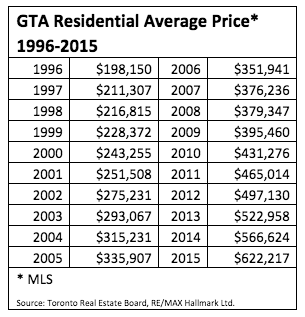

Our real-estate market has seen consistent increases in the cost of housing, with the average price of a detached home in Toronto increasing by over 32 per cent this past November from the same month last year, according to the Toronto Real Estate Board.

While those who prefer urban living have embraced higher-density housing, folks looking for traditional ground-oriented housing must move farther and farther away from the city to find it.

So what if there was a way to introduce new ground-oriented housing in the heart of Toronto that could accommodate up to 100,000 people, and the solution was literally in our backyard all along? That is, if your backyard is along a laneway.

Laneway housing is an innovative concept first introduced in Toronto back in 2006. And while it ultimately went nowhere here, it did inspire Vancouver, Ottawa and other cities to introduce policies that embraced it.

The original concept a decade ago contemplated a separate dwelling being legally severed and requiring new municipal services, resulting in the digging up of laneways.

The new groundswell of interest in laneway housing (call it laneway housing 2.0) is focused on taking a different approach, where the new structures will be treated as secondary dwellings on the existing property.

That means the garage at the rear of the property could be rebuilt by the owner to include a secondary dwelling unit, potentially serviced through the existing municipal connections, limiting neighbourhood disruption and creating new appropriately sized, ground-oriented housing units that could range in size from 700 to 1,500 square feet.

This could represent one of the most innovative solutions to a wide range of the city‘s housing needs, including multi-generational households where the owner can provide accommodation for parents or children or introduce much needed rental housing stock and help generate new income from their property. And it would be creating new ground-oriented housing in areas close to transit and existing community amenities, with minimal neighbourhood disruption.

There is no silver bullet solution to solve all of our housing challenges in the GTA, but with approximately 300 kilometres of laneways in the City of Toronto, laneway housing could be a good start.

But this innovation will require that everyone works together: citizens, government and industry. And community consultations are underway. If you’re interested, you can participate by going online to: lanescape.ca/survey to learn more about the initiative and provide your input.

Remember: The best way to predict the future is to help create it.